The data is clear. Index Funds win almost every time.

Professionals can’t beat Index Funds

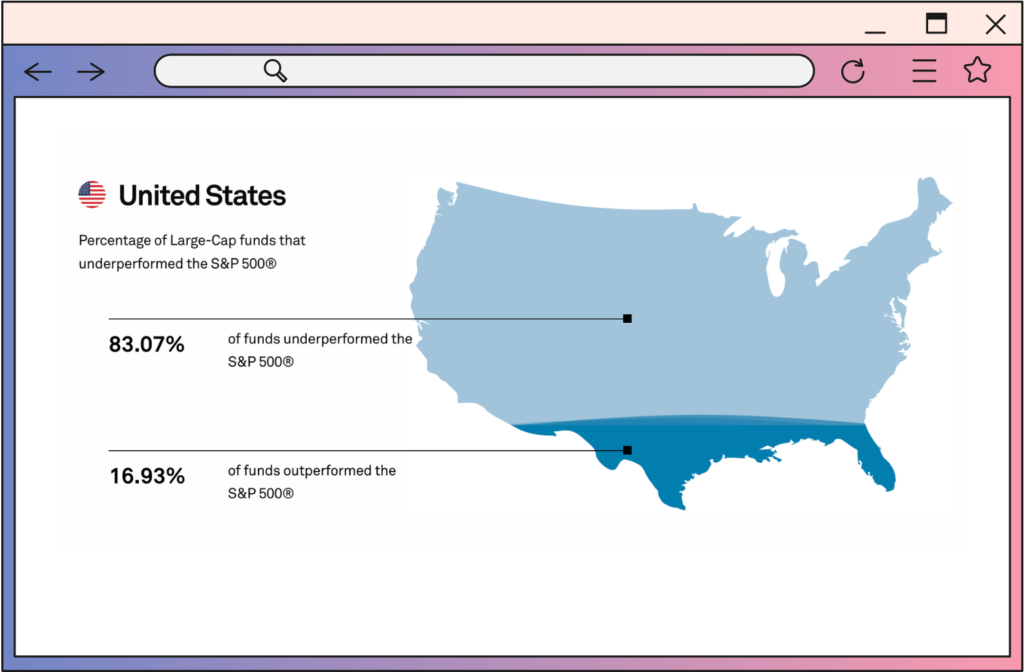

Here’s a sobering stat: 83% of fund managers underperformed the S&P 500 over the past 10 years. Index Funds are simply too efficient to compete against. While this data is bad for investing firms, it’s good for you because it shows you don’t need to pay hefty fees to someone to invest for you.

Warren’s $1 million dollar bet

Warren Buffet is one of the only professionals who can consistently beat the S&P 500. His number one piece of advice for almost all investors? Invest in low-cost Index Funds.

In 2008, Warren Buffet made a $1 million dollar bet with a hedge fund that over the next decade he would be able to outperform them by simply investing in an S&P 500 Index Fund.

The outcome? As you probably guessed, he beat them handily without ever having to lift a finger.

Since then, his confidence in Index Funds hasn’t wavered and he wants 90% of his estate to be invested into an S&P 500 Index Fund when he dies.

Is stock picking ever a good idea?

Given the poor track record of stock picking, many people firmly believe that Index Funds are the only way to invest.

While we mostly agree, we think it’s reasonable if someone wants to invest in particular companies or cryptocurrencies they’re excited and knowledgeable about. The key is that it should be a small percentage of fun money with the vast majority going into Index Funds. Stock picking can be addictive like candy, while Index Funds are more like fruits & veggies, so it’s smart to make a plan for what a healthy balance looks like for you and to stick to it.

Pro tip: the S&P 500 is cap-weighted meaning that S&P 500 Index Funds invest more heavily into companies that have larger market size. So you’re already getting a lot of exposure to popular companies like Apple, Microsoft and Tesla without needing to invest in them individually.